|

Executive Summary

- US stocks could continue their rally despite 2019’s spectacular returns and the record length of the current rally. Employment is high. Interest rates are low after three successive rates cuts1. There is plenty of money in the system which, even if it doesn’t find its way into the economy, is likely to find its way into the stock market in the form of share buybacks. Concerns of a trade war with China have de-escalated as both countries announced steps to ease the tensions.

- Economic growth over the past decade has actually been rather mediocre compared to other expansions. Thus, if there were to be a recession, it would likely be relatively mild and short-lived. While there are multiple risks to the economy and the market, these risks are the usual list of suspects: if the Fed were to resume tightening, will share buybacks continue, a resumption of U.S.-China trade tensions, a material decline in fiscal stimulus (deficit spending), potential change in policies as a result of the elections in the U.S., and a possible war in the Middle East. Each of these risks either has a low probability or is unlikely to throw the US economy into recession.

- Despite 2019 being one of the best years in the past two decades for stocks2, fund flows show that individual investors are anxious and have been moving money out of stock-focused funds and into cash and bond funds3. The outflows are a sign that investors are not chasing stock prices creating a bubble. This suggests stocks have room to run even after a decade-long rally.

- 2019 was a good year for international stock returns, even if not as spectacular as those of US large cap stocks. The fact that international stock returns have lagged US stocks for a decade increases individual investor perceptions that stock exposure should be limited to the U.S. However, if one adopts a longer or even intermediate term view, recent underperformance positions these stocks as relatively undervalued (i.e., cheaper).

- The outlook for US stock and credit markets is highly uncertain. Although we have not had a bear market since 20094, we have had several significant pullbacks since then. The most recent decline was in the last quarter of 2018 which, while just shy of 20% and therefore escaping the technical definition of a bear market, did reset the market for a big advance in 2019, and potentially 2020. While there is plenty of uncertainty, there remain a number of factors including low interest rates globally, a jump in money supply5, slow-but-growing earnings, low unemployment, a somewhat weaker dollar toward the end of 20196, and easing trade tensions that remain supportive for stocks.

- Given the uncertain outlook for stocks we continue to advocate for broad diversification within and across strategies. I realize that during this slow but steady market, this is starting to sound like the same advice we shared last quarter and several quarters before, making me feel like the play-by-play announcer for a turtle race, but prudence is at the heart of decision making in the face of uncertainty.

Background

2019 gave us plenty of news and a lot to think about. The Federal Reserve (Fed) changed its policy outlook mid-year, and recession worries rose as the trade tensions mounted. Manufacturing data and indicators related to international trade showed weakness. In the end, US consumption remained strong through 2019. The US economy continued steadily forward with low unemployment and rising but still low inflation. In international markets, Europe and China’s exposure to trade and reliance on manufacturing made them casualties of the trade war, requiring global central banks to intervene with added stimulus. Despite these challenges—or maybe thanks to the central bank reactions they prompted—investors enjoyed impressive returns for 2019 in almost all financial assets. Even though the global economy is now a full decade into a historic expansion, the overall growth during the decade has been mediocre compared to previous expansions, leaving room for continued expansion.

Global Stocks

Globally, stocks delivered impressive gains in 2019 supported by accommodative central banks, stable inflation and moderate economic growth – a scenario few investors imagined at the start of this year. The S&P 500 finished with a gain of 31.5%7 for the year, its best annual performance since 20138. While 2019 returns are noteworthy, their magnitude was driven by a low starting point after the sharp sell-off late in 2018. For perspective, the S&P 500 is finishing 2019 about 10% above its 2018 high9; US stocks enjoyed strong performance across all sectors. However, large-cap growth stocks in the technology sector were the clear leader for the year gaining 50.3%10. International equities, while also enjoying double-digit returns for the year, trailed US equity markets once again. Developed international equities, as represented by the MSCI EAFE index, rallied 22.7%11. Emerging markets, as represented by the MSCI EM index, rose 18.9%. A preliminary trade deal and a reduced likelihood of a trade war could provide for greater confidence in global economic growth in 2020.

Interest Rates

Developed market central banks reversed course in 2019 to provide monetary stimulus. The European Central Bank (ECB) reintroduced its asset purchases along with a rate cut.12 The Federal Reserve enacted its “mid-cycle adjustment” and cut interest rates three times13. In addition, the yield curve inversion, often mentioned as historically preceding recessions, returned to normal14, meaning shorter-dated US Treasury obligations yield less than longer-dated ones. The return to monetary easing resulted in an unusual state where bonds across the credit spectrum posted strong positive returns for the year. Returns on high-quality and government bonds, as represented by the Barclays US Aggregate Index, rose 8.7%15. High-yield corporate bonds also posted solid returns of 14.3%16 in 2019.

Recession Risks Remain Low

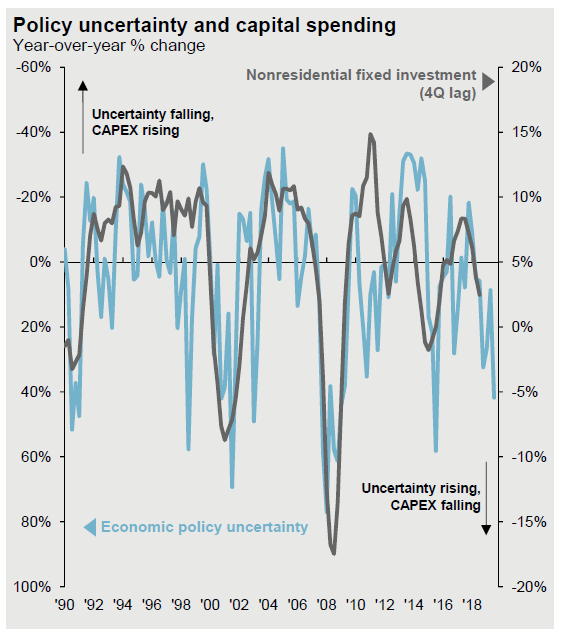

Looking ahead to 2020, there are multiple risks to the economy, including the possible resumption of the U.S.-China trade war, which could stall global business confidence and investment spending. Increased policy uncertainty has historically led to lower capital spending, as seen below17. However, with a slowing economy in China and a presidential election cycle in the U.S., it is likely that both China and the U.S. have incentives to complete a “phase 1” of a trade deal soon.

Source: J.P. Morgan

In addition to trade tensions, there are other risks to the economy and the market which include the usual list of suspects: if the Fed were to resume tightening, whether there will be continued share buybacks by companies, a material decline in fiscal stimulus (deficit spending), potential change in policies as a result of the elections in the U.S., and a possible war in the Middle East. Each of these risks either has a low probability (e.g., Congress reducing deficit spending during an election year) or is unlikely to throw the US economy into recession.

We believe the tailwind of the Fed’s interest rate cuts from 2019 are likely to provide stabilization to US economic output. Against the backdrop of a strong labor market, consumer spending will continue to remain a driving force for 2020. Abroad, the global economy remains at an inflection point as the effect of easier monetary policy filters through to economic activity. Global manufacturing, as measured by Purchasing Manager data (PMI), is now showing tentative green shoots after contracting (an index level below 50) earlier in the year.

Finally, as we have shared in our previous quarterly updates, cyclical sectors of our economy, like home construction and auto sales, remain healthy18. Similarly, fund flows out of stocks and into bonds over the last year show the memory of the financial crisis is still fresh in the minds of consumers and businesses, making them more risk averse. These indicators, which have historically helped explain expansions and recessions, are not showing the excesses or bubble characteristics that often precede a recession. The good news is that the slow growth, benign inflation, and easy monetary policies from central banks could be conducive to the economic expansion continuing for far longer than investors suspect, keeping at bay the risk of a deep or extended recession.

US Elections

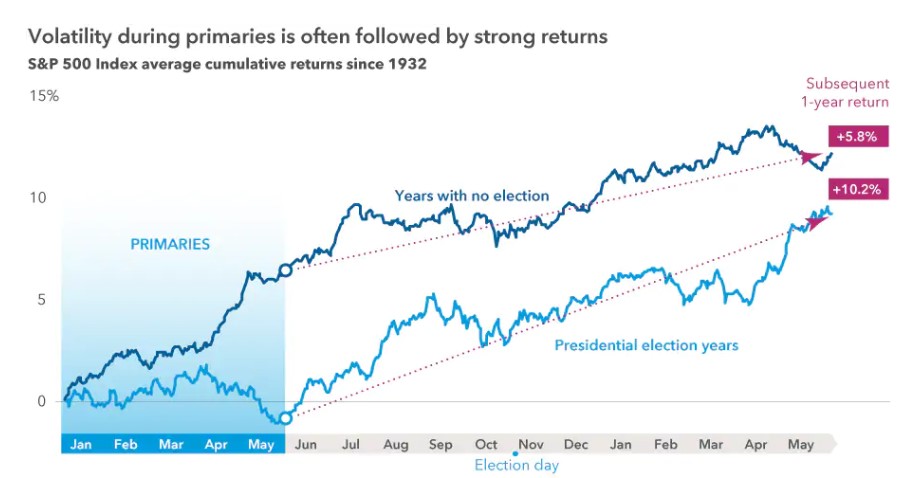

It would be hard to not discuss the elephant (or donkey) in the room as US elections, impeachment, and politics will likely continue to dominate the headlines. While the country’s politics are highly energized and polarized, policies—and not politics—are what move markets. In order for policies to change, we would need to see the same political party win the presidency, the House and the Senate. At the moment this seems unlikely, as it will be difficult for Democrats to win a majority in the Senate or for Republicans to win a majority in the House. As a result, the most likely outcome is a stalemate that will frustrate any radical change and generally will be viewed as reassuring by business and investors. Research by Capital Group finds, despite heightened volatility during primary season, since 1932 the S&P 500 has risen an average of 10% in presidential election years (twice the average return in other years), regardless of which party wins the White House19.

Source: Capital Group

Consider potentially undervalued areas of the market for the long-term

While recession risks remain low, uncertainty abounds. Diversification will remain key for 2020. In addition to potentially helping reduce the overall risk and volatility of a portfolio, a diversified mix of geography, asset classes and strategies – including those that seem undervalued or out of favor – could allow investors to capture opportunities not visible in the rear-view mirror. Here are some strategies investors could consider going forward:

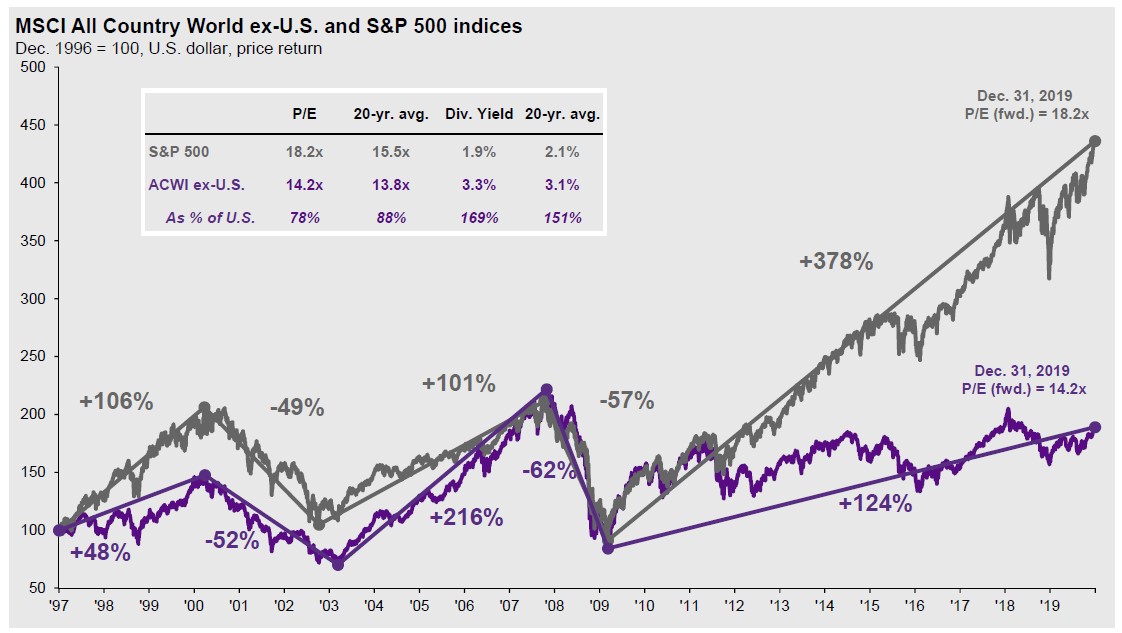

International equities

International equities have lagged domestic equities for the last decade. Since 2009, US stocks have gained over 378%, while international markets are up less than half of that at 124%, as seen in below.20 As international equities have lagged by such a wide margin, valuations on international equities are still above their historical average, but by a smaller amount then US stocks, leading them to look more attractive relative to their own history than US stocks. Valuation has not been a particularly good a predictor of short-term price performance, but at its extremes can be useful in forecasting the long-term trend.

Source: J.P. Morgan

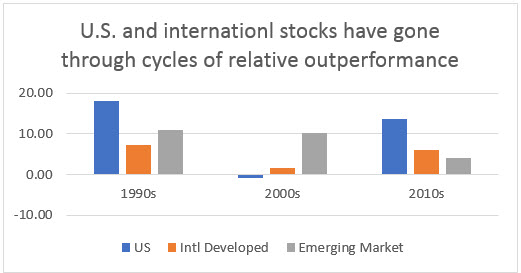

The performance trend for international equities over the last decade looks dismal right now, however similar patterns have emerged before. Historically, developed international and US equity markets have shown cyclical performance, where one outperforms the other for several years until the cycle reverses.21 Timing of when the pattern may reverse is hard to predict. However, mean reversion, the tendency for investments to revert to long-term averages, is a powerful force and international trends are no exception.

Finally, while US stocks indexes have had higher returns than international stocks indexes in the aggregate for the past several years, a closer look at individual companies instead of index returns paints a different picture. According to research by Capital Group, 74% of the top 50 stocks each year since 2010 have been based outside the U.S. In 2019, 44 of the top 50 stocks were located outside the U.S.22, providing further evidence for including international investing in diversified portfolios.

Source: AssetMark

The hunt for value

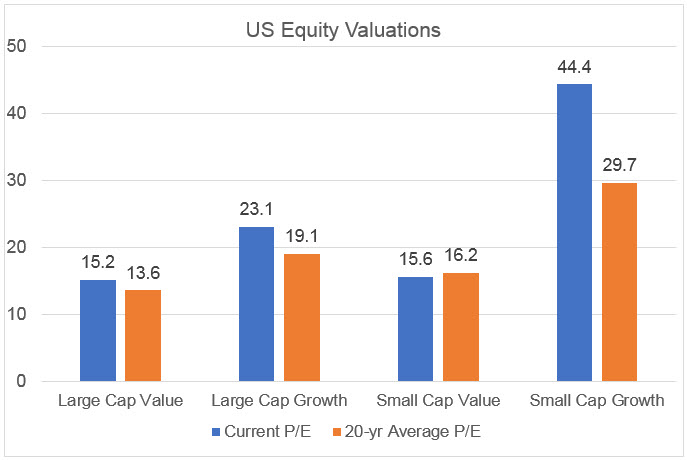

Looking within the U.S., a confluence of historically low interest rates and technological disruption from Silicon Valley have made growth stocks the winner over the last decade. Since 2010, the Russell 1000 Growth Index rose 312%, while the Russell 1000 Value index gained 205%23. Value stocks’ prolonged underperformance relative to growth stocks this cycle, while unusual, is not unprecedented. This extended period of outperformance has extended valuations in growth sectors. Regardless of market cap, the growth style P/E ratios are above their long-term averages. In contrast, P/E multiples within the value sector are either only slightly above, or below their long-term average, making them relatively more attractive compared to growth sectors and the S&P 50024.

Source: AssetMark

Let bonds be bonds:

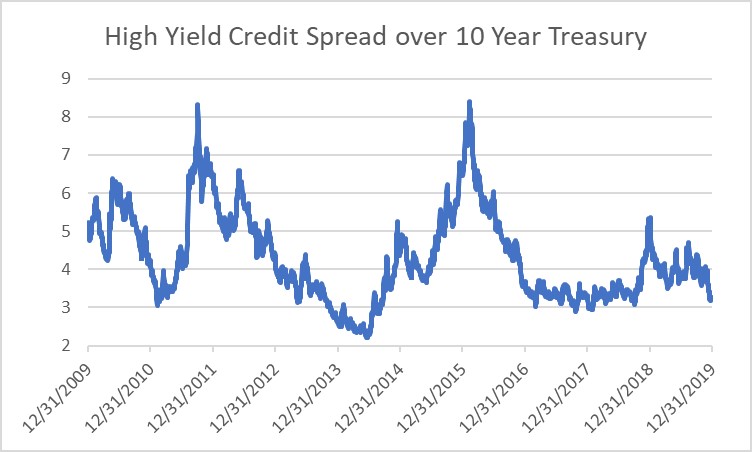

Central bankers have conducted an unprecedented experiment since the 2008 financial crisis. In an effort to jump start sluggish economies, foreign central banks have pushed interest rates to the negative nominal yields seen in some European countries. Currently, nearly 25% of global bonds have negative yields. In this world of low-to-negative interest rates, the 10-year US Treasury yield of 1.92%25 and stock dividend yields in the same neighborhood offer attractive yields for foreign investors. This has led to strong demand and returns for US assets. Higher demand for bonds pushes their prices up and yields down. Although interest rate cycles are quite long, yields today are relatively low and will likely rise at some point, thus investors need to temper return expectations as it’s unlikely they will see the price appreciation experienced to date and over the past decade continue. Finally, caution is warranted as investors can be lulled into a false sense of security by holding higher yielding investments like high yield bonds. Credit spreads, which represent a compensation for purchasing lower quality bonds, have narrowed to the tightest levels26, leaving little to cushion investors in event of market volatility.

Source: AssetMark

High-yield sectors tend to move in sync with the stock market and have risk characteristics similar to equities. Although they offer lower yields, higher quality core bonds should continue to offer diversification to equities, while more credit-sensitive areas, such as high yield bonds, would be vulnerable in an equity correction. The primary role for bonds will be long-term risk management and to help cushion a portfolio in times of equity downturns.Finally, investors should look to maintain broad diversification across bonds, by sector, maturity and credit spectrum.

Outlook

The preliminary US-China trade deal and the UK election reduced some of the uncertainty in the global economy, but some uncertainty and policy risks remain. European central bank rates are already negative, so we are unlikely to see further rate cuts in the near future. On the other hand, monetary stimulus can take a year to work its way through the system, so a European recovery may yet happen. Given our proximity to elections in the U.S., the Fed is unlikely to change (cut or raise) rates in order to avoid being accused of interfering with the upcoming US presidential election, and while inflation is building, it is still quite low. As a result of the Fed’s rate cuts in 2019, the US dollar’s value on a trade-weighted basis relative to other currencies weakened during the fourth quarter of 201927. If this continues in 2020, it would support potentially improving competitiveness of corporate earnings of US companies that sell their goods and services abroad, as well as boosting international investment returns for US investors.

It is also worth noting that the forward price/earnings multiple on US stocks is at approximately 18x and remains above its 25-year average of approximately 16x. It is still well below what has been its all-time high of nearly 25x as seen during the tech bubble28. While it feels safe to observe that above-average values are usually associated with below-average returns, in the near-term there may be room for price earnings multiples to grow or for “easy, low-cost credit” to finance more share buybacks allowing prices to climb further.

Portfolio Positioning

Humility is the investor’s friend because investing essentially requires making decisions in the face of an uncertain future. The challenge is to construct portfolios that would allow for maximum return with as much risk as is tolerable without risking a catastrophic outcome in the event the worst-case scenario is realized. To avoid a catastrophic outcome, diversification is paramount. The opportunity cost of diversification can be thought of as paying an insurance premium on your house, which on a short-term basis may feel expensive and useless, however in the event of an emergency not having insurance can have catastrophic consequences.

It’s feasible that we continue the current trend where stocks outperform bonds, however we may see some mean reversion among different categories of stocks with small cap stocks potentially catching up with large cap stock returns for the longer term or value stocks potentially catching up with the spectacular long-term returns of growth stocks. Even international stocks may outperform, as their valuations relative to their own history remain reasonable especially if European monetary stimulus finally kicks in.

In the face of uncertain outcomes, diversification within and across investment strategies is prudent even if it is somewhat familiar advice. Income-oriented investors seeking diversification may consider adding options-writing or higher quality bonds to a strategy that is otherwise focused exclusively on high yield for income. Growth-oriented investors seeking diversification may consider the addition of a managed futures or tactical limit loss strategy to lower total portfolio risk. The boring truth is that investment markets, with memorable exceptions, often move slowly and steadily through uncertainty, which make this feel like a play-by-play commentary for a turtle race, but just because diversification isn’t new doesn’t mean it’s not wise.

|