|

The situation

Every day we learn more about COVID-19 and its likely impact on our society and our economy. Unfortunately, at this point, the news on both fronts only seems to get worse as the virus is spreading at least as quickly in the U.S. as it has in Asia and Europe, and the number of individuals affected get larger and estimates for the length of time the coronavirus will be with us is extending. In this environment as people practice “social distancing” to protect themselves and slow the spread of the virus by avoiding travel, movies, restaurants and bars, they are effectively withdrawing from the economy. This will inevitably lead to smaller businesses closing and larger businesses at least contemplating layoffs. Worries of infection are now augmented with worries about layoffs. U.S. Treasury Secretary Mnuchin warned that unemployment might reach 20% if the U.S. fails to have a comprehensive plan to address this. To date, the Fed has moved aggressively to create liquidity in the banking system to protect credit availability and the president has signed into law the first $1 trillion coronavirus relief/stimulus package that includes provisions for free testing and paid emergency leave.1 These measures however are unlikely to curb the immediate impact on business revenues and income for the next three or even four quarters. The U.S. will go into recession beginning in Q2 of this year and, while there are too many unknowns to forecast the duration of the recession at this time, it seems likely to last at least until the end of this year.

Our understanding of the virus and its impact is evolving so quickly that whatever we think we know today soon becomes out of date. It is therefore not surprising that investors’ uncertainty as measured by the VIX (aka the fear index) is at a record high surpassing the peak during the Great Financial Crisis of 2008/2009.2

Messages for Investors

At the same time that investors are worried about the health of their families and friends, they are also worrying about the impact on their portfolio. While past experience is often the best guide, I’m not sure we can rely on it alone to forecast the expected duration of this recession given that there are so many unknowns about the virus. From my perspective, the main difference here, from past event-driven recessions and bear markets, is that no amount of monetary or fiscal stimulus will get people back in movie theaters or on airlines as the spread continues. The issue is not that they don’t have cash to spend, it’s that they don’t want to risk infecting elderly parents and other vulnerable people by bringing the virus home. Needless to say, as Mark Twain once commented, “while history doesn’t repeat itself, it often rhymes”, which is to say there are still some lessons to learn from past bear markets and recessions.

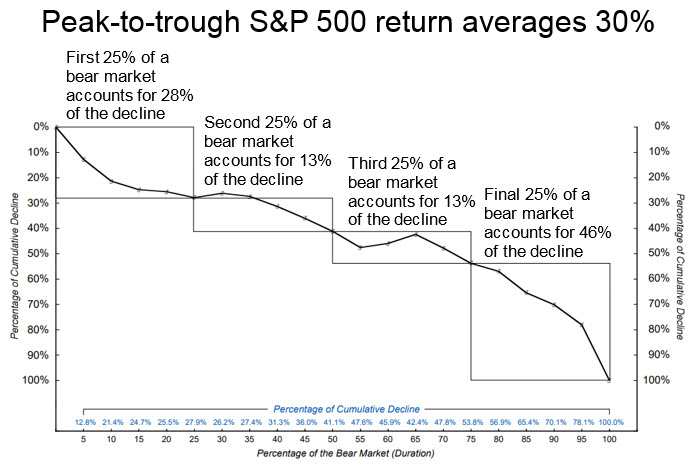

The first lesson is to try to avoid emotional decision-making (easier said than done, when your life savings is at stake). As we’ve shared in the past, the problem with emotional exits from the stock market is that they are rarely combined with a clear and detailed strategy for when to re-enter the market. As a result, investors flee to safety and too often remain uninvested until most of the markets recovery is behind them. The decision to protect the remainder of their savings comes at a cost of locking in the current loss.On the other hand, an investor that has a higher risk tolerance may feel an urgent need to buy before everyone else does. An alternate approach is to consider adding to investor portfolios a tactical strategy allocation designed to provide a disciplined process to move from stocks to cash and back, depending on the market environment. My colleague Jason Thomas, AssetMark’s Chief Economist, talks about the anatomy of a bear market, which tends to be characterized by steep losses at the beginning of the market decline followed by slower losses while the market seeks confirmatory data. This is then followed by steep losses again toward the end of the bear market as investors capitulate. The implications of this sequence of declines is that investors still have an opportunity to work with their advisors to reposition themselves into tactical strategies that will adapt as the markets continue to move but will do so based on discipline rather than emotion. The current environment also provides investors the opportunity to reconsider their risk profiles and to either move into less volatile strategies with smaller equity allocations or into higher risk models with larger equity allocations.

Bear markets evolve in a similar pattern

Average of post-WWII bear markets. Current bear market is not reflected. As of 3/13/20. Source: Crandall, Pierce.

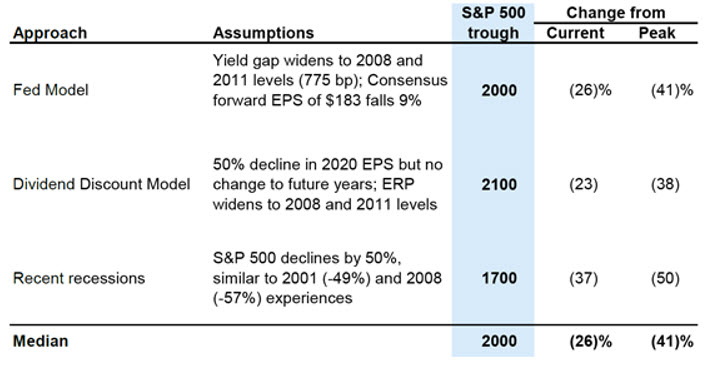

While remembering that there are limits to what we can learn from history, perhaps the most important lesson to take away from the history of bear markets and recessions is that the value of all US corporate behemoths will not disappear and the potential bottom for the stock market is not zero. For investors wondering just how bad it can get, in a recent market note Jason Thomas looked at three different ways of estimating a likely worst case for the S&P 500. He looked at an equity risk premium model (valuing the market relative to the 10-year Treasury Yield), a dividend discount model and recent recessions model (specifically 2001 and 2008). His educated guestimate suggests an S&P 500 low of 2000 (vs. its all-time high of 3386 on February 19, 2020), which would be a decline of 41%.

For investors who are worried we are about to start an extended bear market reminiscent of the Great Depression, it is worth pointing out to them that we learned some important lessons from the Great Depression of 1929 when the Fed actually raised rates and restricted credit availability, accelerating job losses and bankruptcies. This month the Fed has moved aggressively to lower rates and protect credit availability to help companies through the tough times. Shares will likely begin to bounce back when the market anticipates people travelling, meeting and shopping again with the confidence that either they have been vaccinated or that the rate of new infections has receded. The average bear market historically has lasted 14 months. There’s too much uncertainty to know whether it will be longer or shorter, but even if we were to adjust that time frame for a slightly longer period to reflect the estimate for how long it might take to develop a vaccine, investors who have a time frame of more than a few years might rationally decide to add to their stock positions or to at least stay invested in the stock positions they already hold.

Estimates of potential near-term S&P 500 trough

As of 3/13/20. Source: GSGIR.

Strategies for Investors

Staying the course is the advice most investors who are saving for retirement have already heard, but there are strategies beyond changing risk profiles or adding an allocation to tactical strategies that investors may want to consider. Investors may want to use the opportunity of the deep pullback in prices to realize tax losses that can be carried forward to offset future capital gains (such tax transition strategies are available from custom managers as well as from Savos) or to transition from standard IRAs to Roth IRAs. Also, worth a second look are trend-following strategies, such as managed futures, with the flexibility to be short as well as long. Although historically they have lagged markets, should the downward trend continue, such strategies may begin to make money precisely because stock prices continue to fall.

Perhaps the current market environment is most challenging for investors who are currently in retirement or near retirement. Investors in retirement worry that if they draw down their stock and bond holdings pro rata, their retirement savings might not last as long as originally estimated because they would be locking in losses from selling their stock allocation. In such an instance, an advisor can add significant value for clients by helping them to think about ways to defer selling their stock to give stock prices a chance to recover. For example, investors may want to consider a securities-backed line of credit collateralized by their portfolio or even a mortgage to buy time for the value of stocks to re-gain some ground. The stress experienced by investors near retirement may be multiplied if they are worried that they may get laid off as their employer tries to cut expenses to partially offset their anticipation of significantly lower revenues. As a result, investors near retirement may not be able to add as planned to their retirement nest egg and may need to start taking payments from the portfolio sooner than anticipated. At the same time, they may experience unanticipated needs for cash if their children or relatives need a hand to manage through the recession. For this reason, retirement income solutions that provide flexibility and liquidity may be preferred to annuities. It is in times like these when a calm and caring advisor can make all the difference in helping investors to either prepare for retirement or manage through it.

Advisors also have an opportunity to help investors identify talented asset allocators and active stock managers and strategists. For the past decade it has been difficult to deliver better performance than a broad stock market index in part because the index performance was driven by a few large companies whose weight in the index only grew as their share price appreciated. In contrast, talented active managers and strategists who have been vetted by advisors and research providers now have the opportunity to invest thematically through the stages of the recession and the recovery that follows.

When markets drop precipitously, it is difficult or impossible for individual investors to get out of the way fast enough relative to professional money managers and institutions. For that reason, they are probably better off trying to focus on the opportunities ahead and potential allocations to tactical strategies that can de-risk in the near term and systematically participate when the market eventually recovers. In the meantime, perhaps the most we can do is to try to keep our families safe and to try to be thoughtful of and helpful to our neighbors and clients during this unusually stressful period.

All of us at AssetMark are here for you. Please feel free to reach out if you have questions or if we can help.

|